Start Your Investment Journey

Transform your financial future. This guide turns complex stock market concepts into simple, interactive lessons. Scroll down to begin.

Why Invest? The Power of Growth

Saving money is good, but investing makes your money work for you, helping it grow faster than inflation. This section demonstrates the powerful difference between simply saving and actively investing your money over time. Use the interactive calculator to see your own potential.

The Market: What and Who

The stock market is a platform where you can buy ownership stakes (shares) in companies. This section introduces the core components of the market: the different places to invest your money (asset classes), the key players involved, and the regulator who ensures fair play for everyone.

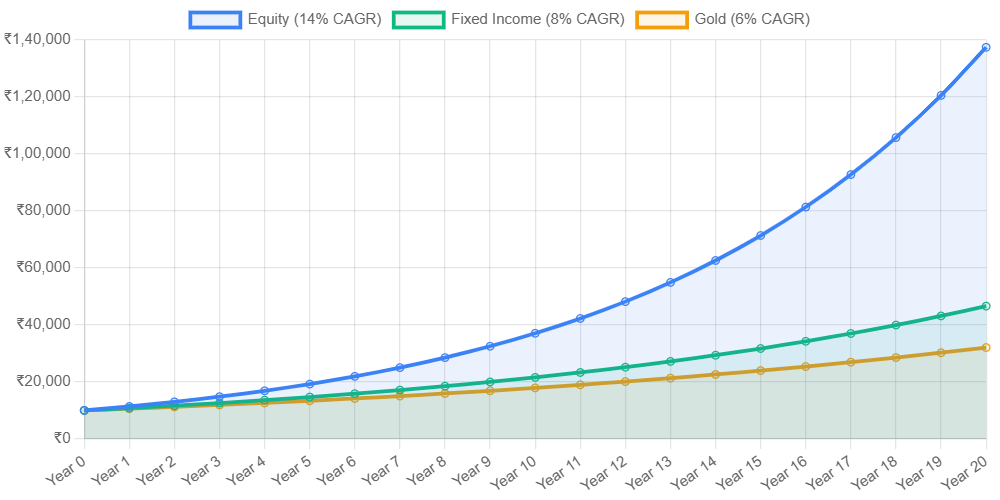

Comparing Asset Classes

Different types of investments, or "asset classes," offer different levels of risk and potential return. The chart below shows the hypothetical growth of ₹10,000 over 20 years in various asset classes, based on historical average returns. Notice how equities have historically provided higher growth over the long term.

The Exchanges

The market's foundation. In India, the two main stock exchanges are the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange), where all buying and selling happens electronically.

The Regulator

To ensure a fair and transparent market, the Securities and Exchange Board of India (SEBI) acts as the watchdog. It protects investors, prevents fraud, and sets the rules for all market participants.

Market Participants

Includes individuals like you (Retail), large Indian institutions like LIC (DIIs), Mutual Funds (AMCs), and major global investment funds (FPIs/FIIs).

Financial Intermediaries

These entities make the market work: Stock Brokers (your gateway to the market), Depositories (who hold your shares electronically), and Banks (for fund transfers).

The IPO Journey: From Idea to Public Company

Ever wonder how a company gets listed on the stock market? It's a journey that starts with an idea and involves several stages of funding before the company "goes public" through an Initial Public Offering (IPO). This section visualizes that journey.

Idea & Seed Fund

An entrepreneur has an idea. The first money comes from self, family, or Angel Investors.

Venture Capital

As the business grows, it attracts professional investors called Venture Capitalists (VCs) for expansion.

Private Equity

A mature, profitable company may get large investments from Private Equity (PE) firms to scale up globally.

Initial Public Offering (IPO)

The company sells its shares to the general public for the first time, getting listed on the stock exchange.

Recent Indian IPOs (2024-2025)

Company Name

Listing Period

Listing Day Gain/Loss

Ola Electric

Dec 2024

6.2%

Swiggy

Jan 2025

15.1%

PayU

Feb 2025

-2.5%

FirstCry

Mar 2025

22.0%

Aakash Education

Apr 2025

8.7%

Hexaware Technologies

Jan 2025

11.3%

IPO performance data is for illustrative purposes. Past performance is not indicative of future results.

Your Turn: Get Started with Trading

Ready to make a move? This section covers the practical steps. First, understand the key accounts you'll need. Then, define your style: are you a short-term trader or a long-term investor? Finally, try our interactive simulator to understand how different order types work.

1. Trading Account

Opened with a stock broker (e.g., Zerodha, Groww). This is where you place your buy and sell orders.

2. DEMAT Account

Linked to your trading account. It holds your shares electronically, like a bank account for stocks.

3. Bank Account

Your regular savings or current account, linked to your trading account for transferring funds in and out.

Contact Us for Any Queries

Address

Door No.10, Site No.5, RMR Fairlands, 4th Floor, Park Road, Fairlands, Salem 636016 Tamil Nadu India GSTIN 33AAGCH4131E1Z4

HQ: HST Investments Pvt Ltd, level 9, Olympia Teknos, Sidco inds Estate, Gunidy, Chennai 600032.

Contact@hstradeschool.com

hstradeschool@gmail.com

Phone

+918870694567

The IPO Journey: From Idea to Public Company

Ever wonder how a company gets listed on the stock market? It's a journey that starts with an idea and involves several stages of funding before the company "goes public" through an Initial Public Offering (IPO). This section visualizes that journey.

RBI Repo Rate

6.50%

As of Jun 2025

The rate at which RBI lends to banks. Stable rate suggests a watch-and-wait approach on inflation.

CPI Inflation (YoY)

4.83%

As of Apr 2025

Consumer price inflation. A downward trend is positive as it eases pressure on the RBI to raise rates.

IIP Growth (YoY)

5.0%

As of Mar 2025

Index of Industrial Production. Growth indicates a healthy industrial sector.

GDP Growth (YoY)

7.8%

As of Q4 FY24

Gross Domestic Product growth. A key measure of the economy's health.

Common Corporate Actions

Dividends

Company shares profits with its shareholders. A sign of financial health. (e.g., TCS, Reliance often declare dividends).

Bonus Issue

Company gives free extra shares to existing shareholders. This increases the number of shares and reduces the price per share.

Stock Split

Company divides existing shares into multiple shares to make them more affordable and increase liquidity.

Share Buyback

Company buys back its own shares from the market, reducing the number of outstanding shares, which can boost the share price.

Your Journey Continues

You've completed the first step! The world of finance is vast. Continue learning about Fundamental Analysis, Technical Analysis, and Risk Management to become a more informed investor.

This page is for educational purposes only and is not financial advice. All data is illustrative.